Explore & Play

Discover interesting topics and solve the accompanying crossword puzzle.

Currency Unit Crossword: Key Currencies and Their Global Impact in 2026

Table of Contents

Currency unit crossword

You can either fill in the crossword puzzle directly on this page or click the button in the bottom right corner to print it for free.

——————————————

Understanding Currency Units: Key Currencies and Their Global Impact in 2026

Picture this: a crisp banknote exchanged between hands in a bustling market halfway across the world, or the quiet jingle of coins dropped into a street vendor’s palm. Currency units—those familiar names like the dollar, euro, or yen—are more than just symbols on paper or metal. They are the lifeblood of global economics, the threads weaving together countless transactions, investments, and everyday exchanges that fuel our interconnected world.

At its core, a currency unit is the standard measure of value for a country’s money. It’s the language everyone uses to price goods, settle debts, and make deals. Whether you’re buying a cup of coffee in Paris or signing a multimillion-dollar contract in New York, these units frame the value that turns intentions into reality.

But their importance stretches far beyond individual wallets. Currency units act as a pulse on international trade—fluctuations influence everything from the cost of importing electronics from Asia to the price tag on luxury goods from Italy. Investors watch these movements closely, as shifts can signal economic health or turbulence, shaping decisions on where to put money or pull out.

Understanding currency units helps us see not just numbers, but the invisible forces at play in global finance—policies, market sentiments, and the complex interplay of nations. It’s a language spoken in boardrooms, markets, and coffee shops alike, influencing how wealth flows across borders and cultures.

This article aims to take you beyond the exchange rates and charts. We’ll explore the key currencies shaping 2026—how their histories echo in today’s trends, the cultural stories behind their symbols, and the economic currents that drive their value. Together, we’ll untangle myths and reveal the human stories behind the numbers, inviting you to see currency not as cold statistics, but as living threads connecting past, present, and future.

The Economic Outlook for Major Currency Units in 2026

Stepping into 2026, the world’s major currencies each carry their own stories—shaped not just by numbers on charts, but by policies, cultures, and shifting global winds. Let’s walk through the outlook for some key players.

Euro: Strengthened by German Fiscal Stimulus

Germany, the powerhouse of Europe, is rolling out fiscal stimulus that’s expected to breathe new life into the Eurozone economy. This means more government spending and investment pushing demand upward, giving the Euro a solid boost against the US Dollar. Imagine the Euro gaining some muscle, thanks largely to Berlin’s moves—this could tighten the usual dance between these two heavyweight currencies.

US Dollar: Current Trends and Challenges

The US Dollar remains the global heavyweight, but it’s not without its headaches. Federal Reserve decisions and mounting uncertainties keep markets on edge. Investors watch closely as the Dollar navigates pressures from inflation concerns and international competition. Despite the noise, the Dollar’s role as the world’s preferred reserve currency keeps it central to global trade—even as its strengths ebb and flow.

Swiss Franc: The Safe-Haven Currency

When the world feels uncertain, many investors turn to the Swiss Franc like a cozy refuge. This reputation keeps it surprisingly strong, even in times of turmoil. Reports from 2024 and 2025 underscored its steady performance, a dependable anchor in choppy financial seas. Switzerland’s political stability and sound banking system make the Franc a quiet guardian in global currency markets.

Chinese Yuan: Growth and Policy Support

China’s Yuan is on an upward trajectory, with forecasts pointing to a modest strengthening hovering around 6.8 against the US Dollar. This reflects Beijing’s careful balancing act—stimulating the economy with policy support while maintaining currency stability. The Yuan’s rise hints at China’s growing influence on the world stage, inviting curiosity about how this shift reshapes trade and investment flows.

Indian Rupee: Regional Movement and Trends

The Indian Rupee is carving its own path in Asia’s financial landscape. Expected to strengthen to about 94 per US Dollar by year-end 2026, the Rupee’s journey is paced by controlled “crawl” mechanisms—slow and steady nudges that reflect India’s cautious approach to currency management. This mirrors broader trends in Asian markets, where regional economies interplay with global forces.

Norwegian Krone: An Economic Indicator

Sitting somewhat in the background but no less telling, the Norwegian Krone offers clues about economic health beyond its borders. Norges Bank keeps a watchful eye, but interpreting signals from this currency can be tricky—it’s indirectly linked to oil prices and global market moods. The Krone isn’t just currency; it’s a pulse check on Norway’s economic heartbeat and, by extension, larger trends in commodity-driven economies.

As 2026 unfolds, these currencies tell a story far richer than numbers alone. They remind us that money moves aren’t just financial—they’re deeply woven into the fabric of national strategies, regional dynamics, and the ever-shifting currents of global trust.

Cultural and Historical Context of Currency Units

Step into any bustling Japanese neighborhood, and you’ll quickly notice something that might surprise even seasoned travelers: the clink of coins in pockets and purses. Japan’s yen coins—ranging from the humble 1 yen to the sturdier 500 yen piece—are not just small change; they are woven tightly into the everyday fabric of life. Vending machines await your exact amount, shopkeepers hand back precise change with practiced grace, and cash remains king in a society famously punctual and orderly. This heavy reliance on coins is more than convenience—it’s a reflection of cultural values that prize simplicity and respect for detail.

The evolution of yen coins tells a story as quietly compelling as the country itself. Introduced in the late 19th century during the Meiji Restoration, the yen was designed to modernize Japan’s monetary system, shifting away from feudal-era currencies and aligning more closely with Western standards of trade. Over the decades, the metals and sizes changed, marking shifts in economic conditions and technological advances. Yet, unlike many nations that have drifted toward cashless transactions, Japan’s coin culture endures, a testament to the country’s blend of tradition and innovation.

Travel a little further south to Chile, and the Peso offers a contrasting chapter in currency history. The Chilean Peso, adopted in the early 1970s, carries with it the echoes of national identity and resilience. Its notes and coins bear images of heroes and landscapes, reminding users daily of Chile’s rich heritage and the struggles that formed the modern state. The Peso’s steady presence amid global financial currents makes it not only a medium of exchange but a symbol of continuity and pride.

Finally, cast your mind back to Italy’s Lira, a currency that once danced through the pockets of Venetians, Romans, and Sicilians alike. Its story winds through centuries—a silent witness to Renaissance art, the unification of Italy, and the rise and fall of empires. When the Euro replaced the Lira in 2002, it was more than a monetary change; it marked Italy’s deeper embrace of European unity. Yet, for many Italians, the Lira remains a cultural touchstone, evoking nostalgia and sparking tales of prices long past and ways of life that shaped the vibrant streets of their cities.

These currencies, whether still in everyday use or living on as memories, carry more than coins and notes—they hold stories, identities, and the rhythms of daily life. They remind us that money is never just money; it is a bridge linking past and present, culture and economy, the personal and the global.

Debunking Common Myths About Exchange Rates

It’s easy to think that exchange rates are just numbers bouncing up and down because people are buying and selling currencies. But the truth? It’s a lot more tangled than that. Let’s break down some of the biggest myths that often trip people up.

Myth 1: Exchange Rates Depend Solely on Supply and Demand

Sure, supply and demand play a role—more buyers or sellers will nudge prices. But what about when central banks step in quietly, shifting interest rates or buying their own currency to stabilize things? These moves often happen behind the scenes, like a skilled puppeteer altering the strings. Geopolitical shakes—think trade disputes or elections—can suddenly tip markets in ways that pure supply-demand logic can’t explain. So, it’s not just a free-for-all marketplace; policy and politics weave through the numbers.

Myth 2: Currency Strength Reflects Only Domestic Economic Health

A booming economy might seem like the obvious reason for a strong currency. Still, international investors don’t live in a bubble. Their feelings about global risks—wars, pandemics, or even shifts in another country’s policy—can push currencies around. For example, a currency might weaken even if its home country’s economy is doing well because investors prefer safer bets elsewhere. The world economy is interconnected, and markets react like an orchestra, not solo instruments.

Other Common Misconceptions

Some folks suspect that all currency moves are the result of manipulation or secret market interventions. While it’s true that governments sometimes engage to smooth out wild swings, outright currency manipulation is rare and closely watched. More often, what looks like market meddling is just a complex dance of regulations, interest rate changes, and investor psychology. Remember, currency markets are among the most liquid and scrutinized in the world—there’s a lot at play beneath the surface.

In short, exchange rates are a living story of economics, politics, strategy, and human behavior. Next time you glance at a currency chart, imagine the invisible hands shaping those lines, and you’ll see a narrative far richer than just numbers jumping around.

Factors Driving Currency Unit Fluctuations in 2026

Currencies rarely move in a straight line, caught instead in a dance of forces both visible and hidden. To understand why one currency rises while another dips, we need to look closely at the three main factors shaping the scene in 2026.

Central Bank Policies and Monetary Strategies

At the heart of currency shifts lie the decisions of central banks—the world’s quiet puppeteers. When a bank raises interest rates, it’s like turning up the volume on a currency’s appeal, drawing investors who chase higher returns. Conversely, easing policies or quantitative measures pour more money into the system, often softening the currency’s value. In 2026, shifts in these policies—especially from major players like the Federal Reserve, the European Central Bank, and the People’s Bank of China—will ripple across markets, shifting exchange rates as traders react to every tweak.

Geopolitical Events and Global Economic Conditions

No currency exists in a vacuum. Political stability, trade negotiations, and conflicts can all jolt currency values unexpectedly. Consider how the tug-of-war over trade agreements or regional tensions can either stoke confidence or breed caution among investors. In 2026, lingering trade disputes and new alliances will continue to sway currencies like the Yuan and the Krone, reflecting more than just raw economic numbers but the very health of international relationships.

Market Sentiment and Investor Behavior

Beyond data and policies lies the less tangible—mood, perception, and confidence. When markets crave safety, they flock to traditional havens like the Swiss Franc or the Japanese Yen, pushing these currencies higher even in uncertain times. On the flip side, risk-on attitudes send money chasing potentially bigger rewards in emerging markets or higher-yield currencies like the Rupee. This ebb and flow of risk appetite often magnifies reactions to news and economic reports, making 2026 another year where investor psychology plays a pivotal, if sometimes volatile, role.

Ultimately, currency fluctuations reflect a blend of strategy, circumstance, and human behavior—a complex interplay that keeps global markets alive, shifting, and full of surprises.

Summary of Key Currency Unit Forecasts for 2026

As we step back and take in the slate of currency movements expected in 2026, a clearer picture emerges—one that reflects both economic shifts and deeper stories woven through culture and history. The Euro, bolstered by Germany’s fiscal push, seems set to hold steady against the US Dollar, which continues to wrestle with its own set of headwinds and the weight of its global reserve status. Meanwhile, the Japanese Yen, with its unique coin culture that touches daily life so tangibly, remains a quiet but powerful player.

The Swiss Franc stands resilient, its safe-haven reputation shining through turbulent times, while the Chinese Yuan’s steady climb hints at Beijing’s carefully crafted policies nudging their currency toward stability and growth. Not far behind, the Indian Rupee shows promise, mirroring Asia’s dynamic economic pulse, even as the Norwegian Krone quietly signals Norway’s broader economic health through subtle shifts.

Don’t overlook legacy currencies like the Chilean Peso and Italy’s old Lira—each carrying tales of transformation, cultural identity, and adaptation in a rapidly globalizing world. Together, these currencies tell a story of interconnected economies, historical journeys, and cultural footprints.

For businesses and investors, this mosaic of currency forecasts underscores the need for nimbleness. Strategies that factor in both market signals and the rich context behind numbers will hold the key. Whether hedging risks or seizing new opportunities, understanding these currency rhythms offers a compass for navigating the uncertain seas ahead.

In the end, currency units are more than just numbers on a screen—they’re living threads connecting past and present, economics and culture, local stories and global movements. In 2026, paying attention to these threads may be the smartest move for anyone with a stake in the world’s financial tapestry.

As we step back from the numbers and forecasts, what stands out is just how much currency is more than a tool for trade—it’s a living thread woven through the fabric of economies, cultures, and histories around the world. In 2026, major currencies like the Euro, US Dollar, and Chinese Yuan will continue to carry weight not only in global finance but also as symbols shaped by unique national stories and policy choices.

Understanding these currencies means appreciating both their economic muscle and the human stories behind them—like the Japanese yen coins jingling in bustling markets or the Chilean peso echoing its nation’s heritage. Currency units, after all, are reflections of trust, policy decisions, and collective confidence.

Looking ahead, the shifts and fluctuations we expect are reminders that currency markets are dynamic, influenced by an ever-changing mix of central bank moves, geopolitical currents, and investor moods. For businesses and individuals alike, staying informed is less about predicting certainty and more about embracing complexity—recognizing that behind every exchange rate lies a story worth knowing.

So as you navigate the world of currency in 2026, consider it a journey through interconnected histories and economies, where each unit tells a part of the larger human tale—and where understanding these stories equips us to engage more thoughtfully with the global stage.

Share to...

I hope you enjoy the content.

Want to receive our daily crossword puzzle or article? Subscribe!

You may also be interested in

Share to…

Want to receive our daily crossword puzzle?

-

Jigsaw Puzzles

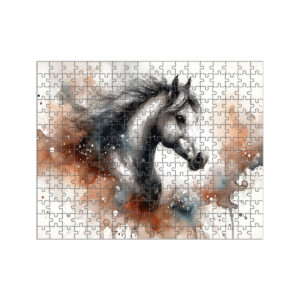

Majestic Horse Watercolor Jigsaw Puzzle 250 | 300 | 500 Pieces

kr 348,00 – kr 439,00Price range: kr 348,00 through kr 439,00 Select options This product has multiple variants. The options may be chosen on the product page -

Jigsaw Puzzles

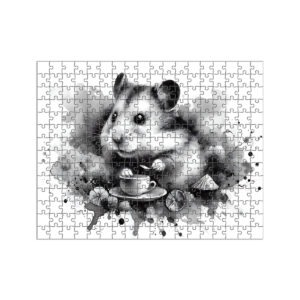

Whimsical Hamster Jigsaw Puzzle in Watercolor Style 250 | 300 | 500 Brikker

kr 348,00 – kr 439,00Price range: kr 348,00 through kr 439,00 Select options This product has multiple variants. The options may be chosen on the product page -

Jigsaw Puzzles

Zodiac Series Tiger Ink Puzzle – Black and White Art 250 | 300 | 500 Pieces

kr 348,00 – kr 439,00Price range: kr 348,00 through kr 439,00 Select options This product has multiple variants. The options may be chosen on the product page